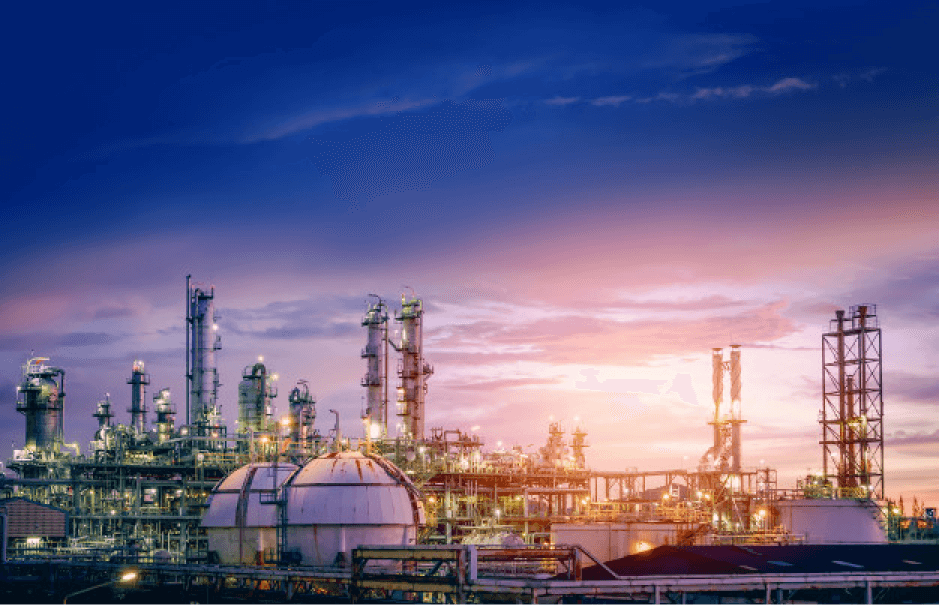

2021 oil & gas industry

July 1, 2021 2021-07-08 13:142021 oil & gas industry

2021 oil & gas industry

Exploring oil and gas trends and impact of COVID-19

The oil and gas industry is used to the highs and lows of economic cycles. The downturn caused by COVID-19, however, is unlike any other. With the survival of many companies at risk, coupled with a longer-term decline in petroleum demand, the next decade could look very different for the oil and gas market. Explore what the next year may look like in our 2021 outlook.

Facing the challenge of transformation for the oil and gas industry

Since we published our midyear outlook in July, the global economy and capital markets have rebounded faster than expected in the third quarter of 2020. However, the pace of recovery in the coming months remains highly uncertain as mounting COVID-19 cases amid winter conditions, especially in Europe and the United States, may trigger another round of shutdowns and restrictions. Any further normalization of economic activity largely depends on how the pandemic evolves during the winter and, most importantly, when COVID-19 vaccines reach the general public. Even when the virus is controlled, economies are expected to continue dealing with the adverse impact of deteriorated fiscal balances and the effect of muted business investment on the labor market and consumer spending in 2021.

What does this mean for the oil and gas (O&G) industry? Global oil demand fell by 25% in April, but it has rebounded sharply since then, cutting its losses to just 8%. Looking ahead, 2021 oil demand is expected to recover strongly but remain lower than it was at pre–COVID-19 levels—about 4% lower in the base case, and about 7% lower in Rystad Energy’s second-wave scenario. Similarly, oil prices and energy stocks have underperformed base metals and the broader S&P 500 index by about 10% and 25% and 6% and 10%, respectively, since July 2020. Mass layoffs and heightened cyclicality in employment continue to challenge the industry’s reputation as a reliable employer. US O&G companies laid off about 14% of permanent employees in 2020, and our research shows that 70% of jobs lost during the pandemic may not come back by the end of 2021.

Although the oil and gas sector is used to the highs and lows of economic and price cycles, this downturn seems unlike any other. In fact, it’s the “great compression” of the O&G industry. With the survival of many companies at risk, and the longer-term decline in petroleum demand, the next decade could look very different for the entire O&G value chain. 2021 will either be a leapfrog year or a test of endurance for many. We see five oil and gas trends that may challenge traditional methods of oil and gas production in 2021, determine the direction of the industry, and begin separating the pioneers from the followers.

Five oil and gas trends to consider

The corridor of uncertainty

Bail out the shale

Crisis accelerates big oil and gas trends

Is natural gas out of gas?

Turbulence down the value chain

The future is now for the oil and gas sector, and the signs are hidden in plain sight

The oil and gas industry was facing market headwinds even before the pandemic started. However, the pandemic has turned into a “fast-forward” scenario for the industry, where what might have taken years to happen has instead unfolded in a matter of months. Pivoting to the new energy future could be tough and may require companies to make bold choices—and not everyone is likely to succeed. The following signposts could help O&G companies in deciding their strategy and direction in 2021:

- The stance and commitment of a new administration on clean energy.

- Changes in end-use demand patterns and supply composition.

- The rise of environmental, socially responsible, and impact-focused investing.

- An adoption of new talent strategies to succeed in the future of work.

- Consolidation in a low-priced environment.

The choices O&G companies make in the coming months, and the trends they prioritize, will decide the path forward and reverberate through their decision-making in the coming decade.

Energy and industrials trends in 2021

Our industry outlook collection, covering oil, gas, and chemicals; power, utilities, and renewables; and industrial products and construction, evaluates sector landscapes to help executives better plan for success and unforeseen challenges.

Look again

In today’s rapidly evolving marketplace environment, key business issues are converging with impacts felt across multiple industry sectors. What are the key trends, challenges, and opportunities that may affect your business and influence your strategy? Look for more perspectives and insights from some of Deloitte’s forward thinkers.